March: Must know Non-Alc News & Data

The most interesting & surprising news in the non-alc space for March was that prominent non-alc beverage retailer, Boisson, filed for Chapter 11 bankruptcy. The company subsequently closed all retail locations as they worked to restructure and define a new business model. Without a doubt, this was a stunning turn of events for a company that, from the outside, seemed to be thriving. Boisson founder Nic Bodkins provided more detail in a personal Linkedin post:

Having served as a supply partner for Boisson, and being intimately familiar with their retail locations, it became apparent that they faced challenges across their retail and e-commerce channels. Boisson positioned itself as the upscale destination for NA beverages, boasting premium locations and a curated assortment. However, despite the overall growth in the NA market, it remains predominantly composed of NA beer (80%) and NA wines/RTDs under $12 (10%). As larger retailers expanded their NA offerings to target the mainstream consumer—the 90% of the market as seen above - Boisson was left with a small addressable market. Unfortunately, the demand proved insufficient for Boisson to sustain its operations.

Boisson has built an incredible brand and I hope they are able to reemerge in a more sustainable way. I can see them being successful as a “store within a store” concept that allows the brand to live on. Similar partnerships such as Target & Sechey seem to be doing well as the companies expand their relationship after an initial trial. Boisson could be a great partnership and/or bargain purchase for Trader Joes and/or Wegmans.

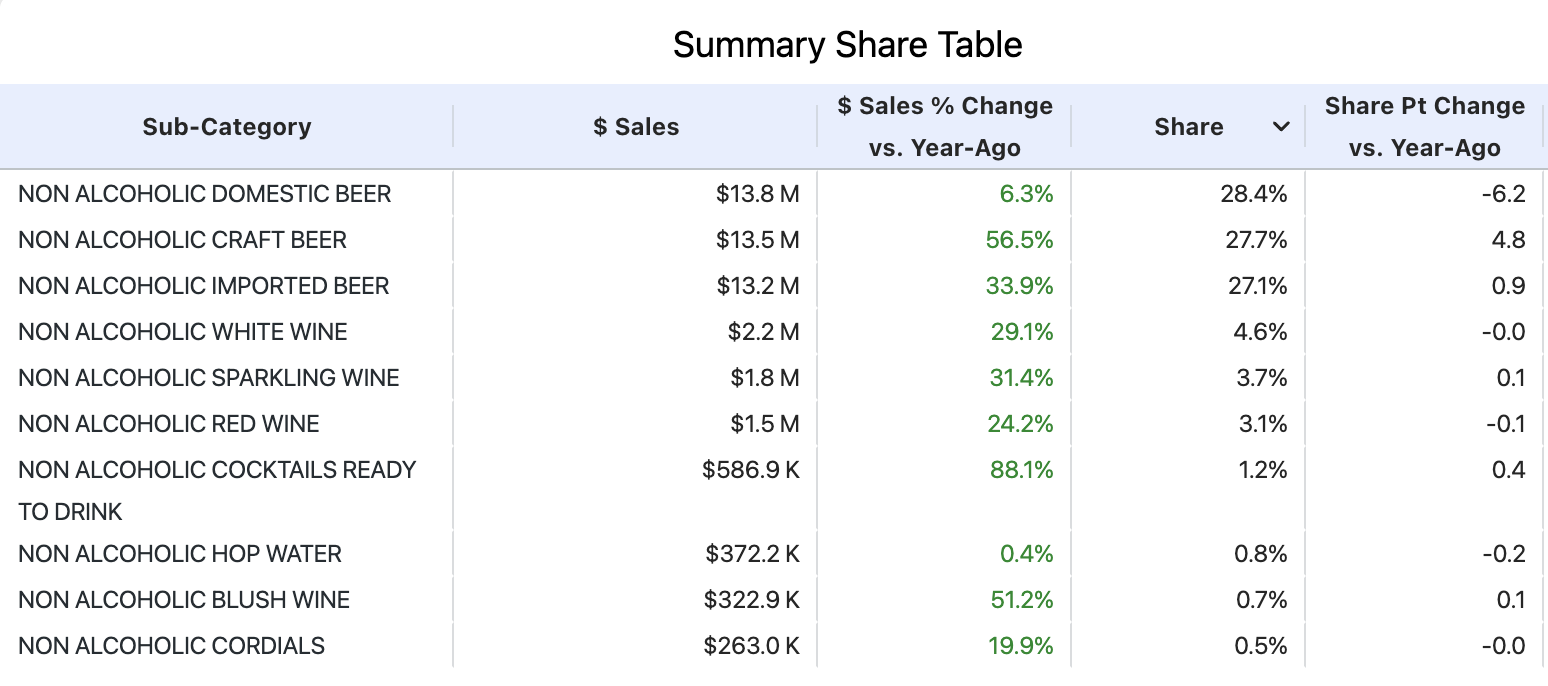

March Off Premise Retail Sales:

-

$48.6M which is about identical to February numbers, up 23% YoY

-

See below for performance by sub-category

After 3 months of data for 2024. We can confidently make some predictions for where the NA market is headed this year.

-

We expect another 30-35% of YoY category growth. Likely 25%+ in off-prem and 50%+ in on-prem.

-

Premium, high quality craft or import NA beers will capture most of the growth of the NA beer market. Customers want unique brands with full flavored options. Domestic NA and Hop Waters are likely to struggle.

-

Big bet on NA RTDs to surpass NA wines by end of year. Sangria would fit neatly into this space.

Geographically, here are the top 5 states for NA consumption. The top 3 are likely simply based on population size. Stay tuned for next month’s update as I’ll look into consumption per capita to help find hidden opportunities & geographies to over-invest.

Stay Gruvi,