February Non-Alc Data & News:

Historically, February has been a very slow month for beverage sales and especially non-alc as the Dry January hype fades. I was quite surprised to see that total non-alc sales volume for February pretty much kept pace with January. This is a really strong indicator for another 30%+ year of growth for non-alc.

Off Premise Retail Sales:

-

$48.5M which is only a 4% decrease of January’s all time high & a 31% YoY increase from 2023

-

82.1% of the category sales came from non-alc beer, which picked up category share from NA wines and spirits.

-

Craft NA beer is continuing to pick up market share against all other NA categories, especially against domestic NA beer brands. Maybe time to swap out O'Douls.....

-

Outside of NA beer, non-alc cocktails saw the 2nd biggest jump in market share while hop waters saw the biggest decline and were almost flat YOY.

-

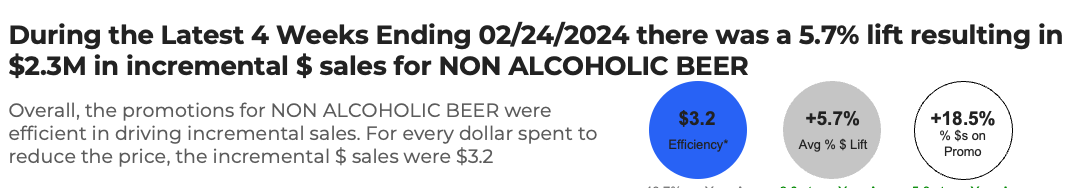

February NA promo was effective at driving incremental sales at a $3.2/1 efficiency and displays drove an 18% lift in sales in February.

General Opinions:

-

At the simplest level, it seems like the products with the most absolute flavor are gaining momentum (Craft beer & RTD cocktails over domestics & hop waters. Consumers are choosing NA beverages as a reward / treat and want to have their taste buds delighted. Anecdotally, it seems like calorie count (at this point of the category’s maturity) isn’t a key driver of purchasing.

-

Promotional activity in this category seems key to continuing to draw in new customers that stick. This should be a focus for brands and retailers.

Non - Data News:

- Continued new non-alc launchs from existing brands. The most recent are Beefeater 0.0%, Tanquerey 0.0%, Blue Moon, Mionetto Prosecco & Sierra Nevada. There seems to be less new brand creation at this time.

- Japan became one of the latest countries to issue a national warning about the health risks associated with alcohol consumption. Japan’s largest brewer, Asahi then cancels plans to launch an 8% RTD to help support the health of its consumers.

- This follow the Canadian government last year reducing alcohol consumption guidelines from 12 drinks a week to no more than 2 drinks a week. We are awaiting word from the US government 😅.

Stay Gruvi,

|