Dry January is Done. Let's Analyze the Data

Dry January’s done. The Super Bowl month for NA brands has passed and now we can dive into the data as we await the actual Super Bowl. I wonder if we'll see any NA commercials this year.

Here are some of the key data points for January 2024, based on Nielsen Total US Retail data.

Off-Premise Retail Sales:

- $62.5M, up 24.5% YoY from January 2023.

- 44.5% sales jump over December

- 30% of sales were on promotion

- NA beer hits 1% of beer volume

These are great benchmarks to determine how your brand, distributor, or retailer is performing against the category average. If YoY growth is below 25%, there’s an opportunity to improve some aspects of the selection, promotion, distribution & marketing.

Big NA promotions in January make sense and are well received by consumers. Seeing 30% of sales generated on promotion does make me think there could be a real strong opportunity to be one of the few brands / retailers that continues to promote heavily in Feb and March. This will attract the consumers that are coming back to the category looking to build a habit. Mental note to test that out next year.

What were consumers buying during Dry January?

Non-alcoholic beer made up 75% of NA purchases and also saw significant YoY growth despite their much higher baselines compared to the other NA categories. It’s looking like consumers are choosing the more premium non-alcoholic options (craft and imports) instead of the domestic NA beers.

This makes complete sense to me, as a lot of Gruvi’s customer data indicates that NA adult beverages are consumed as a treat or reward with 1-2 being consumed per session. This lends itself better to more premium brands for that emotional connection. Of the top 10 NA beer brands, only O’Douls, had a YoY decline in sales. It will be interesting to see what (if anything) AB plans to do with that brand over the next 5 years. Perhaps they can pull off a PBR comeback once NA alc becomes more mainstream and older brands can become popular.

What I also find interesting when looking at the category share of consumption for non-alc is that it is in the direct order of how close the non-alc products taste to their alcoholic counterpart. Non-alc beer is now almost indistinguishable from alcoholic beer. In the wine category, sparkling NA wine is the closest to alcoholic wine while Red Wine is the hardest to crack & finally NA spirits taste the furthest from alcoholic spirits. I would expect NA RTDs to start to pick up real momentum as taste parity improves in the category (Have you tried Gruvi’s NA sangria?)

What Regions Were Buying Non-Alc?

A few interesting pieces of data here, the West region normally leads in NA sales on a monthly basis however this January saw a big jump in the South with very high velocities. I’m wondering if there were some very aggressive promotions for the month at the large retailers or if I need to make a trip down to see what’s going on.

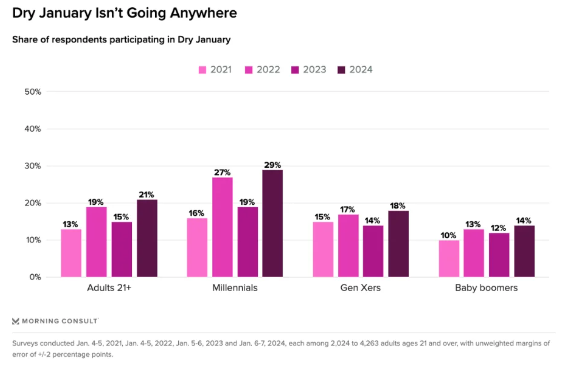

Which demographics participated in Dry January?

All major generations saw an increase in Dry January participating in 2024 with Millennials leading the way with around 30% participating. It seems wise to target the millennial generations for non-alc marketing as it’s likely to pull in Gen Z & Gen Y. There was a huge amount of press covering Dry January this year and I’m going to go out on a limb and predict that 2024 will be the highest participation and coverage. Moving forward, society is on its way to normalizing alcohol moderation and I don’t feel like people will need to take such a cut and dry approach to a whole month on/off alcohol in the future. More people will consume mindfully during the right occasions.

Other Dry January News:

Anheuser-Busch became the first ever worldwide beer sponsor for the next 3 Olympic Games with Corona Cero (0%) as the official beer of the games. This will provide awareness of alc-free alternatives on a massive scale. On a similar scale, Gruvi is looking to become the official NA beer of the Rocky Mountain Vibes; a baseball team in the pioneer league. Got to start somewhere & they have a much cooler logo.

Mindful Drinking Fest: One of the first ever fully alcohol free festivals to take place in Washington DC in January. A gathering of 40+ alcohol free brands, industry experts, consumers and press. It’s been a really great experience to watch a new industry unfold and the community being built around. Come join us next year.

Looking forward to a Gruvi year,